Akhuwat Interest-Free Loan 2026

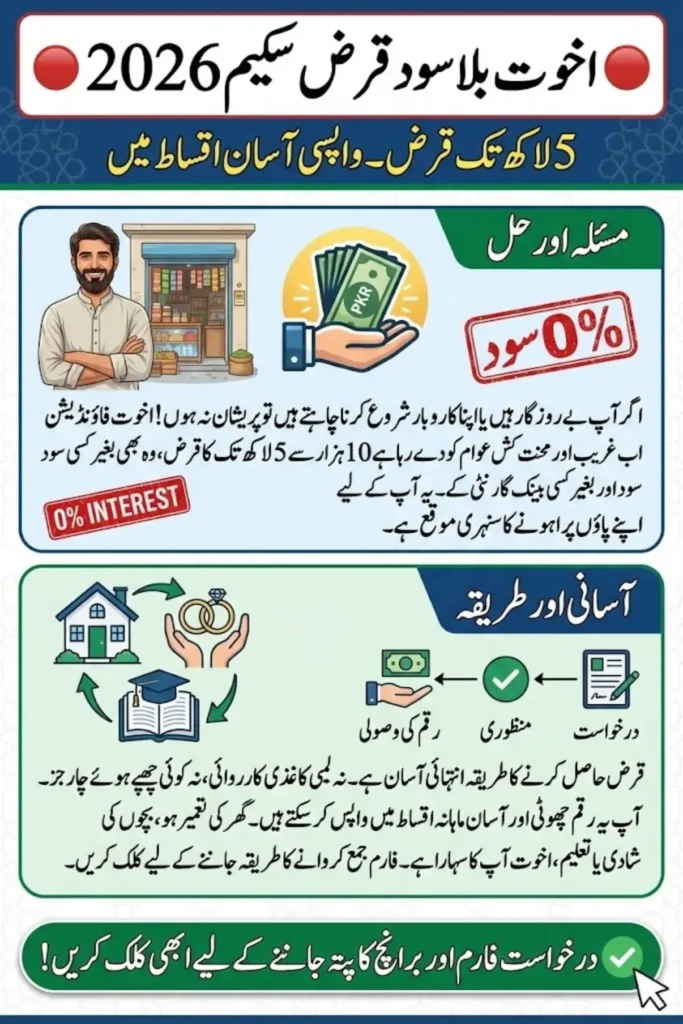

Akhuwat Interest-Free Loan 2026 is a big relief for the poor and labourers in Pakistan who spend their daily lives in difficulty due to unemployment, low income, and rising inflation. Many families cannot take loans from banks because of high interest rates and hard rules, which often increase their financial problems instead of solving them. Akhuwat Foundation provides a trusted alternative by offering interest-free loans to help people meet basic needs, start small businesses, pay education fees, repair homes, and improve their overall quality of life.

“Yeh scheme Pakistan ke ghareeb, mehnat karnay walay aur khud apna mustaqbil behtar banana chahnay walay logon ke liye aik bohat badi rehmat aur sahulat hai.”

Akhuwat Foundation, established in 2001, aims to reduce poverty by providing easy and transparent financial support. Under the 2026 loan program, Akhuwat continue offer loans without interest, processing fees, or hidden charges. With offices across Pakistan and a strong reputation for honesty and fairness, Akhuwat has become one of the most trusted microfinance institutions in the country, giving deserving families a real chance to build a better future.

You Can Also Read: Prime Minister Youth Loan Scheme 2025 Online Apply Know Full Details

Overview of Akhuwat Interest-Free Loan Program 2026

Akhuwat Foundation was established in 2001 with a clear mission to fight poverty through interest-free financial assistance. The 2026 loan program continues this mission by offering transparent, ethical, and accessible loans to low-income families. Unlike commercial banks, Akhuwat does not charge interest, processing fees, or any hidden costs.

“Is program ka bunyadi maqsad logon ko sood aur qarz ke bojh ke baghair apnay paon par khara karna aur khud-mukhtar banana hai.”

The program is built on trust and community participation. Loans are often disbursed through local community centres to maintain dignity and accountability. This unique model has helped millions of Pakistanis improve their financial condition while maintaining an exceptionally high repayment rate.

- Founded on Islamic values of brotherhood and compassion

- Strong focus on poverty reduction and self-reliance

- Nationwide outreach, including small cities, towns, and rural areas

Akhuwat 2026 is a people-centred loan program that promotes dignity, trust, and long-term financial stability.

Eligibility, Documents & Key Conditions

| Category | Details |

| Nationality | Pakistani citizen |

| Age Requirement | 18 years or above |

| CNIC | Valid CNIC required |

| Guarantors | Two non-family guarantors |

| Collateral | Not required |

| Interest | 0% Interest-Free |

| Documents Needed | CNIC, photos, address proof, income/business details |

| Repayment Style | Monthly installments |

| Early Repayment | Allowed without penalty |

Types of Loans Offered by Akhuwat in 2026

Akhuwat provides several types of interest-free loans to support different financial needs. Each loan category is designed to promote productivity, income generation, and long-term improvement rather than temporary relief.

“Akhuwat logon ki mukhtalif zarooriyat ko samajhtay hue har tabqay ke liye mukhtalif qisam ke interest-free loans faraham karta hai.”

- Family Enterprise Loans for small and home-based businesses

- Education Loans for school, college, and university expenses

- Health Loans for medical treatment and emergencies

- Agriculture Loans for farmers and livestock owners

- Housing Loans for home construction, renovation, and repair

- Liberation Loans to free people from high-interest debt

- SME Loans for small and medium-sized enterprises

Mukhtalif loan options Akhuwat ko Pakistan ke har tabqay ke liye qabil-e-rasai banatay hain.

You Can Also Read: How to Apply for the Punjab Asaan Karobar Loan Scheme 2025

Loan Amount and Financing Limits

The loan amount under the Akhuwat Interest-Free Loan 2026 depends on the nature of the loan and the applicant’s financial condition. Akhuwat ensures that loan amounts remain reasonable so repayment remains stress-free.

“Loan ki raqam hamesha applicant ki zaroorat, loan ki qisam aur adaigi ki salahiyat ko madde-nazar rakh kar tay ki jati hai.”

- Small business loans usually range from PKR 10,000 to 100,000

- SME loans may go up to PKR 500,000

- Housing loans can reach PKR 500,000 for construction or repair

- Education loans are given based on actual academic requirements

- Repayment duration ranges from 6 months to 10 years

Munasib financing limits borrowers ko qarz ke dabao se mehfooz rakhtay hain.

Akhuwat Interest-Free Loan Types & Amounts

| Loan Type | Purpose | Loan Amount | Repayment Duration |

| Family Enterprise Loan | Small & home-based businesses | PKR 10,000 – 100,000 | 6 – 36 months |

| SME Loan | Small & medium enterprises | Up to PKR 500,000 | 12 – 36 months |

| Education Loan | Fees & study expenses | Need-based | After education |

| Health Loan | Medical treatment | Need-based | Flexible |

| Agriculture Loan | Farming & livestock | PKR 10,000 – 150,000 | 6 – 36 months |

| Housing Loan | Construction & repair | Up to PKR 500,000 | Up to 10 years |

| Liberation Loan | Freedom from interest debt | Case-based | Flexible |

Key Features of Akhuwat Interest-Free Loans

Akhuwat loans stand out because they prioritise fairness, dignity, and transparency. Borrowers only repay the exact amount they receive, without any additional burden.

“Akhuwat loans ki sab se badi khasiyat yeh hai ke yeh mukammal tor par sood se paak aur insani izzat ke sath faraham kiye jatay hain.”

- 100 per cent interest-free financing

- No collateral or security required

- No processing fees or hidden charges

- Flexible and affordable repayment plans

- Community-based verification system

Yeh khas features Akhuwat ko Pakistan ka sab se bharosa mand loan program banatay hain.

Eligibility Criteria for Akhuwat Loan 2026

To maintain fairness and transparency, Akhuwat has clear eligibility criteria. These rules ensure that loans reach deserving individuals.

“Loan sirf un logon ko diya jata hai jo waqai madad ke mustahiq hon aur zimmedari se qarz ada kar saktay hon.”

- Pakistani citizen with a valid CNIC

- Minimum age of 18 years

- Genuine financial need or business purpose

- Residence near an Akhuwat branch

- Two non-family guarantors

- Willingness to follow ethical repayment terms

Wazeh eligibility rules loan system ko shaffaf aur moassar banatay hain.

You Can Also Read: How to Apply for the Punjab Asaan Karobar Loan Scheme 2025 Know Eligibility Criteria

Required Documents for Application

Applicants must submit basic documents to verify identity and financial need. These documents help speed up the approval process.

“Darkhast ke liye kuch bunyadi documents zaroori hotay hain taake applicant ki tasdeeq ho sakay.”

- CNIC copy

- Recent photographs

- Proof of residence

- Income or business details

- Utility bill copy

Mukammal documents approval process ko tez aur asaan bana dete hain.

Step-by-Step Application Process

The application process is simple, and applicants are guided at every stage by Akhuwat staff.

“Akhuwat loan hasil karna aik seedha, samajhnay wala aur shaffaf process hai.”

- Visit the nearest Akhuwat branch

- Collect and fill out the application form

- Submit required documents

- Field verification and interview

- Guarantor verification

- Approval by the loan committee

- Interest-free loan disbursement

Asaan aur wazeh process har mustahiq shakhs ko barabar ka mauqa deta hai.

You Can Also Read: Punjab T Cash Card 2025 How To Apply Online, Know Full Guide Step By Step

Repayment Method and Duration

Akhuwat offers flexible repayment plans so borrowers do not feel burdened. Repayment usually starts after the loan is utilised.

“Qistain hamesha borrower ki aamdani aur sahulat ke mutabiq tay ki jati hain.”

- Monthly instalment system

- Flexible duration based on loan type

- No penalty for early repayment

- Supportive follow-up instead of pressure

Lacheelay repayment plans qarz ko bojh banne se roktay hain.

Benefits of Akhuwat Loan for Pakistani Families

Akhuwat loans help families improve their income, living standards, and overall quality of life.

“Yeh loan sirf paisa nahi deta balkay logon ko umeed, izzat aur behtar mustaqbil deta hai.”

- Support for self-employment and businesses

- Better access to education and healthcare

- Improved housing conditions

- Reduction in poverty and debt dependency

Akhuwat loans se laakhon families ki zindagi behtar hui hai.

Nationwide Impact of Akhuwat Foundation

Akhuwat’s impact can be seen across Pakistan. Its trust-based system has empowered communities and strengthened social bonds.

“Akhuwat ne apnay interest-free model ke zariye mulk bhar mein laakhon zindagiyan badli hain.”

- Presence in hundreds of cities and towns

- Millions of beneficiaries nationwide

- Strong community involvement

- Exceptionally high repayment rate

Akhuwat ka model Pakistan ke liye aik qabil-e-taqleed misaal hai.

You Can Also Read: Prime Minister Youth Loan Scheme 2025 Online Apply Know Full Details

Overall Conclusion

The Akhuwat Interest-Free Loan 2026 is a reliable and ethical solution for people seeking financial support without interest. Whether the need is business, education, health, or housing, this program offers fairness, dignity, and transparency.

“Akhuwat Interest-Free Loan 2026 Pakistan ke ghareeb aur mehnat karnay walay logon ke liye aik roshan umeed hai.”

By focusing on trust and community support, Akhuwat is not just providing loans but helping build a stronger, more self-reliant Pakistan. For eligible individuals, this scheme can be the first step toward a stable and independent future.

Frequently Asked Questions

“Yahan awam ke liye aham aur aam sawalat ke tafseeli magar asaan jawab faraham kiye gaye hain.”

Can everyone apply for the Akhuwat Interest-Free Loan 2026?

Any Pakistani citizen who meets the eligibility criteria can apply. The applicant must have a valid CNIC, be at least 18 years old, and show genuine financial need or a clear business purpose.

Is the Akhuwat loan completely interest-free?

Yes, the loan is 100 per cent interest-free. Borrowers return only the principal amount without any markup, interest, or hidden charges.

Is collateral or security required?

No, Akhuwat does not require any collateral. The system is based on trust and community verification through guarantors.

How long does the loan approval process take?

The approval process usually takes a few weeks. The time depends on document verification, field visits, and guarantor confirmation.

Can women apply for Akhuwat loans?

Yes, women are strongly encouraged to apply. Akhuwat actively supports women entrepreneurs, students, and households across Pakistan.

You Can Also Read: How to Apply for the Punjab Asaan Karobar Loan Scheme 2025 Know Eligibility Criteria