Key Updates of the Suzuki Alto on Easy Installments

The Suzuki Alto on easy installments in Pakistan has become one of the most searched options for budget-conscious buyers. Due to rising car prices, many customers now prefer bank financing instead of paying the full amount upfront. Suzuki Alto remains a top choice because of its low price, fuel efficiency, and affordable maintenance, making it ideal for installment plans.

Banks like HBL Bank, Faysal Bank, and Bank of Punjab (BOP) offer flexible car financing options for the Suzuki Alto. Using a car finance calculator in Pakistan, buyers can easily estimate monthly installments, down payment, and total financing cost before applying. This helps customers make informed decisions without financial stress.

Suzuki Alto Easy Installments 2026

Own a Suzuki Alto with low monthly payments

Eligibility

Salaried & small business individuals

Installment Benefit

Affordable monthly payments via banks

Registration

Apply online through bank platforms

Target Buyers

Budget-focused city car buyers

Usage Method

Daily city driving with low fuel cost

Verification

CNIC & income documents required

Quick Actions / Key Points

- Choose bank and Suzuki Alto variant

- Verify CNIC, income, and bank records

- Pay down payment & start installments

- Track KIBOR rates for better planning

You Can Also Read: Suzuki Cultus 2026 Prices in Pakistan Announced: Full Comparison of AGS, VXR, and VXL Variants

How Suzuki Alto Installment Plans Work in Pakistan

Suzuki Alto installment plans are designed to simplify car ownership for salaried individuals and small business owners. Buyers can finance both new and used Suzuki Alto models, depending on bank policy and vehicle condition.

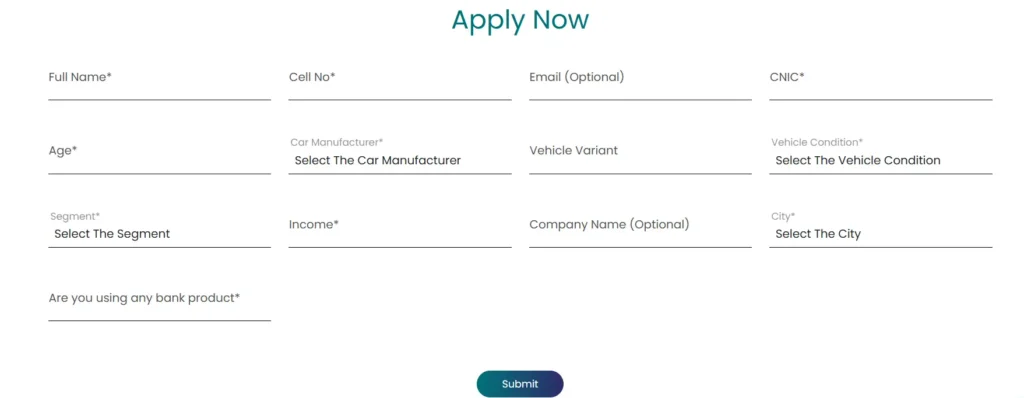

The car finance calculator allows users to enter basic details such as city, Alto variant, tenure, and down payment. Based on this information, the system shows estimated monthly installments from multiple banks, including HBL, Faysal Bank, and BOP.

- Select the Suzuki Alto variant and city

- Choose financing tenure and down payment

- Compare bank-wise installment offers

- Review insurance and processing charges

You Can Also Read: Suzuki Alto 2026 Latest Price in Pakistan – Latest Price, Engine Details, Mileage & Variants

Suzuki Alto Financing Process Through Banks

The car financing process for Suzuki Alto is structured and secure. After submitting an online application, the bank or partner platform verifies personal and financial details to ensure eligibility.

Overview Installment Plan

| Bank Name | Car Model | Financing Rate | Best For |

|---|---|---|---|

| HBL Bank | Suzuki Alto | KIBOR Based | Salaried & Business Buyers |

| Faysal Bank | Suzuki Alto | 15.64% | New & Used Car Financing |

| Bank of Punjab | Suzuki Alto | 13.64% | Lowest Markup Option |

Once verification is complete, the selected bank initiates the financing process. Upon approval, the buyer can proceed with vehicle booking and delivery under the agreed installment terms.

- Online application submission

- Customer details verification

- Bank approval and documentation

- Suzuki Alto delivery

You Can Also Read: CM Parwaz Card Know Eligibility Criteria Latest Update 2026 Know Full Details Step By Step

Suzuki Alto Car Financing Rates in Pakistan

Different banks offer competitive financing rates for the Suzuki Alto based on KIBOR. Rates may vary depending on tenure, down payment, and bank policy.

| Bank Name | Financing Rate | Insurance Rate | Processing Fee |

|---|---|---|---|

| Bank of Punjab | 13.64% | 1.4% | PKR 8,000 |

| HBL Bank | Competitive Market Rate | As per Bank Policy | Varies |

| Faysal Bank | 15.64% | 1.5% | PKR 12,000 |

Rates are inclusive of KIBOR and may change over time.

Benefits of Buying the Suzuki Alto on Installments

Financing the Suzuki Alto allows buyers to manage expenses efficiently without delaying car ownership. Instead of saving for years, customers can spread payments across manageable monthly installments. Car financing also helps build a positive credit profile. Regular payments improve credit history, which increases eligibility for future loans and financing facilities.

- Low initial down payment

- Flexible installment tenure

- Easy budget planning

- Improved credit score

You Can Also Read: Suzuki Cultus 2026 Prices in Pakistan – Latest Rates for VXR, VXL, and AGS Know Details

Documents Required for Suzuki Alto Car Loan

Banks require standard documentation to process Suzuki Alto financing applications. These documents help assess income stability and repayment capacity.

| Required Documents |

|---|

| CNIC copies |

| Passport size photographs |

| Bank statement (6–12 months) |

| Passport-sized photographs |

| Account maintenance certificate |

Impact of KIBOR on Suzuki Alto Installments

KIBOR plays a key role in determining car financing rates in Pakistan. Banks adjust their markup rates based on current KIBOR values, which directly affect monthly installments. A rise in KIBOR can increase installment amounts, especially for long-term financing. Buyers should always check prevailing KIBOR rates before finalizing Suzuki Alto financing.

You Can Also Read: Parwaz Card Apply Online 2026 – Complete Step-by-Step Registration Guide

FAQs

Can I buy a Suzuki Alto on installments in Pakistan?

Yes, the Suzuki Alto can be financed through banks like HBL, Faysal Bank, and BOP with easy monthly installments.

Which bank is best for Suzuki Alto car financing?

Bank of Punjab offers competitive rates, while HBL and Faysal Bank provide flexible financing options.

Does KIBOR affect Suzuki Alto installment plans?

Yes, changes in KIBOR directly impact markup rates and monthly installments.

Is the used Suzuki Alto eligible for bank financing?

Yes, many banks finance used Suzuki Alto models subject to age and condition limits.

You Can Also Read: Suzuki Alto VXL VXR and AGS Prices in Pakistan 2026 Latest Rates Variants and Mileage Details