SBP Financial Inclusion Index

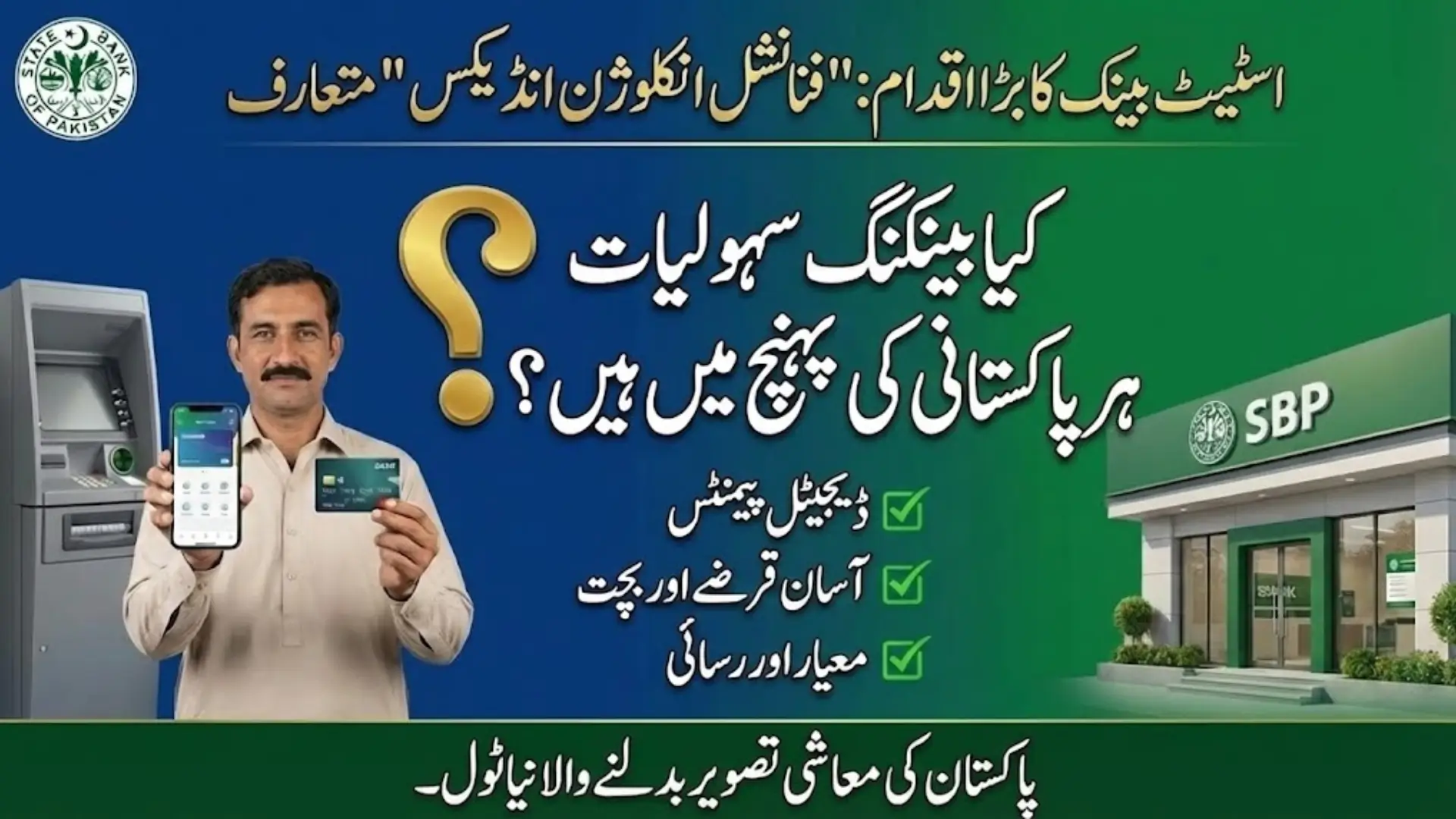

The SBP Financial Inclusion Index, also known as the Pakistan Financial Inclusion Index (P-FII), is a major initiative launched by the State Bank of Pakistan to measure how well financial services are reaching people across the country. Financial inclusion plays a key role in economic growth because it allows individuals and businesses to access banking, digital payments, savings, and credit facilities. Through this index, SBP provides a clear and data-driven picture of Pakistan’s financial landscape.

For ordinary citizens, the SBP Financial Inclusion Index goes beyond the idea of simply owning a bank account. It focuses on whether financial services are accessible, regularly used, and of good quality. By introducing P-FII, SBP aims to ensure that people living in both urban and rural areas can benefit equally from modern financial services.

You Can Also Read: Easypaisa User Growth Report: How Pakistan Is Entering a Digital Banking Era in 2026

Why SBP Introduced the Financial Inclusion Index?

Improving financial inclusion is one of the core objectives of the SBP Act, 1956. The SBP Financial Inclusion Index helps the central bank monitor progress in a structured and measurable way. With the rapid growth of digital banking, mobile wallets, and fintech solutions, a reliable index was necessary to track real usage and service quality.

| Category | Details |

|---|---|

| Overall Financial Inclusion Score | 58.1 (2024) |

| Total Pillars | 3 (Access, Usage, Quality) |

| Total Indicators Used | 69 |

| Access Indicators | Branches, ATMs, Agents per 100,000 adults |

| Usage Indicators | Accounts, Loans, Transactions |

| Quality Indicators | Reliability, Complaints Handling |

| Strategy Linked | NFIS 2024–2028 |

| Publication Frequency | Annual (SBP) |

| Target Vision | 2030 |

The index also helps policymakers identify gaps in the system, such as limited banking infrastructure in rural areas or low adoption of digital payments. These insights allow SBP to design better policies and encourage financial institutions to improve their outreach and services.

You Can Also Read: Winter Vacation Restrictions in Punjab 2025 to 2026: Ban on School Activities and Strict Government

SBP Financial Inclusion Index Score and Key Results

According to the first official results, Pakistan’s overall financial inclusion score stood at 58.1 in 2024. This score shows moderate progress, indicating that millions of Pakistanis are now part of the formal financial system, but there is still room for improvement.

The score acts as a benchmark for future years. An increase in the SBP Financial Inclusion Index score will indicate better access, higher usage, and improved quality of financial services nationwide.

You Can Also Read: Suzuki Alto 2026 Latest Price in Pakistan – Latest Price, Engine Details, Mileage & Variants

Main Pillars of the SBP Financial Inclusion Index

The SBP Financial Inclusion Index measures inclusion using three core pillars:

- Access to financial services such as bank branches, ATMs, agents, and digital platforms

- Usage of services, including active accounts, loans, savings, and transactions

- Quality of services covering reliability, transparency, and customer satisfaction

This approach ensures that the index focuses on meaningful participation rather than just the presence of financial facilities.

You Can Also Read:

Financial Services Covered Under P-FII

The index covers a wide range of services to reflect the real financial experience of citizens. These include conventional and microfinance banks, non-banking financial institutions, insurance providers, and digital payment platforms. By covering banking and non-banking services, the SBP Financial Inclusion Index provides a comprehensive assessment of financial inclusion in Pakistan.

You Can Also Read: Parwaz Card Loan for Overseas 2025–2026: Complete Eligibility, Registration Portal & Online Application

Indicators Used in the SBP Financial Inclusion Index

The P-FII is based on 69 indicators related to infrastructure, usage, and quality. These indicators are benchmarked against defined targets aligned with SBP’s long-term goals for 2030.

| Pillar | Example Indicators |

|---|---|

| Active accounts, loan uptake, and digital transactions | Bank branches per 100,000 adults, ATM availability |

| Usage | Active accounts, loan uptake, digital transactions |

| Quality | Service reliability, complaint resolution |

Link with NFIS 2024–28 and Future Use

The National Financial Inclusion Strategy (NFIS) 2024–28 guides Pakistan’s efforts to expand financial access. The SBP Financial Inclusion Index acts as a monitoring tool to track progress under this strategy. SBP plans to publish the index annually to ensure transparency and accountability.

You Can Also Read: KPK Driving Licence Cards Backlog: CM Orders Clearance of 117,000 Pending Cards

Conclusion

The SBP Financial Inclusion Index is a landmark step toward building an inclusive financial system in Pakistan. With an initial score of 58.1, the index highlights progress while clearly showing areas that need improvement. By using global best practices and local research, SBP has created a strong foundation for evidence-based policymaking and long-term financial empowerment.

FAQs

What is the SBP Financial Inclusion Index?

The SBP Financial Inclusion Index is a tool launched by the State Bank of Pakistan to measure access, usage, and quality of financial services nationwide.

What is Pakistan’s financial inclusion score in P-FII?

Pakistan’s overall score under the SBP Financial Inclusion Index was 58.1 in 2024.

How often will SBP publish the P-FII?

SBP plans to release the Financial Inclusion Index on an annual basis to track progress over time.

You Can Also Read: Electric Buses from Gujar Khan to T-Chowk to Start Next Month Link With Islamabad